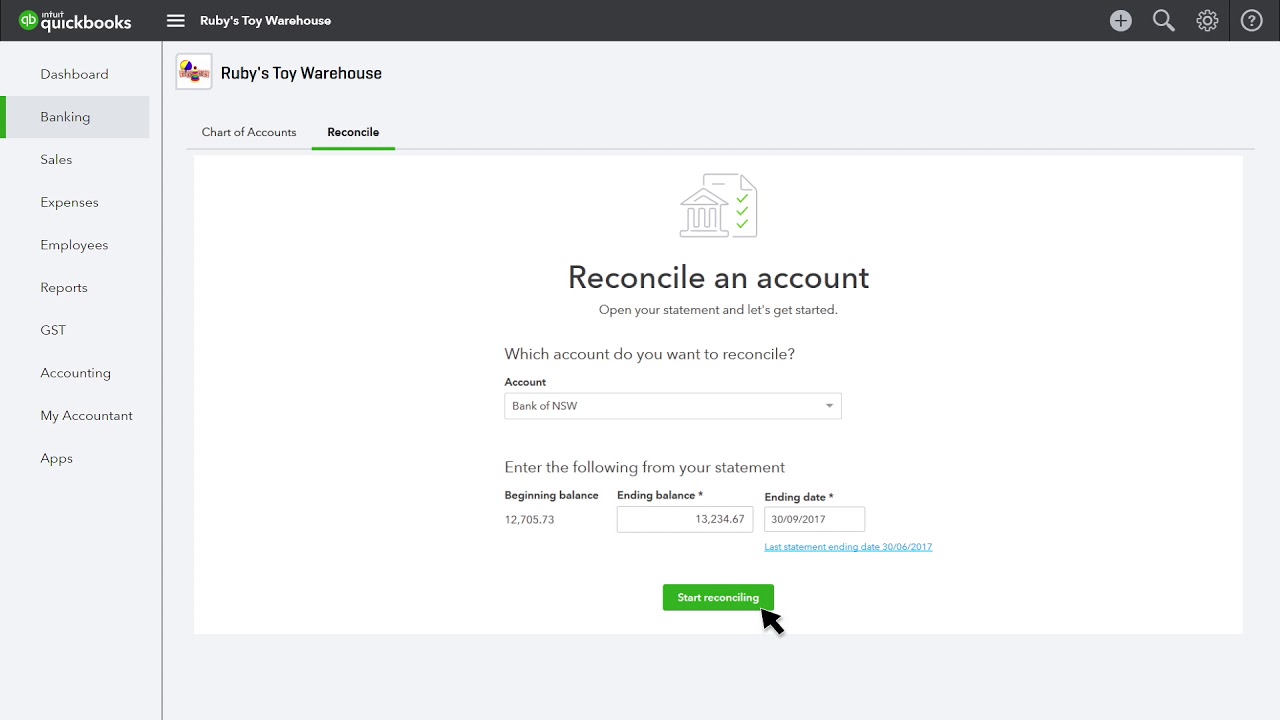

Solved: I get this when I try to lodge me BAS - We can't e-lodge this activity statement, as the software Id i

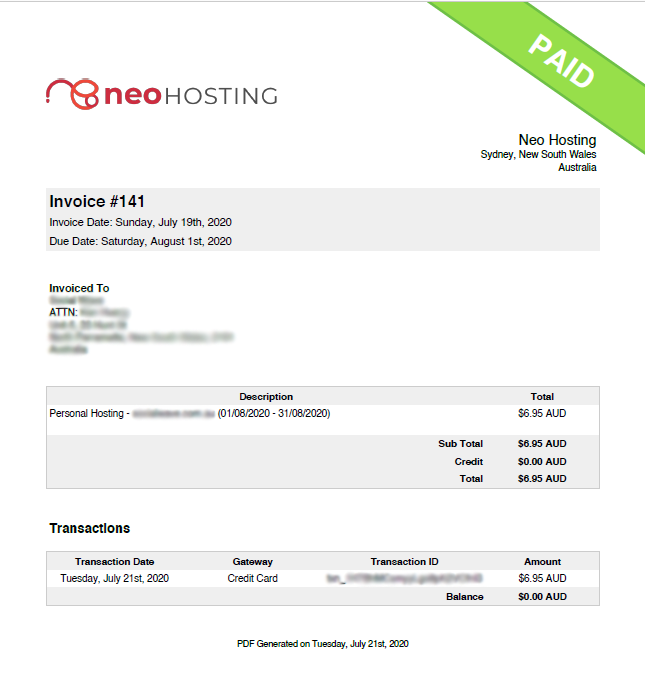

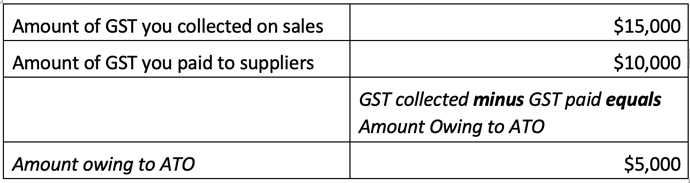

Australian Taxation Office - BAS tip: Check twice to make sure you only have to lodge once! Avoid common BAS errors by checking all invoices are correct, claiming for the current tax