calculate and interpret the bank discount yield, holding period yield, effective annual yield, - YouTube

Treasury Yields -- Quoted on an Investment Basis vs. Discount Basis - Personal Finance & Money Stack Exchange

Bond Pricing P B =Price of the bond C t = interest or coupon payments T= number of periods to maturity r= semi-annual discount rate or the semi-annual. - ppt download

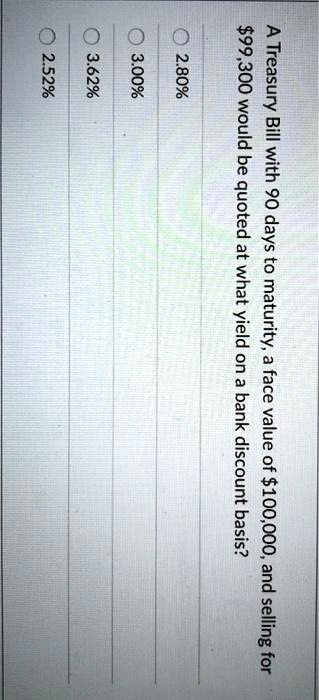

SOLVED: O2.52% O.3.62% %000 O2.80% $99,300 would be quoted at what yield on a bank discount basis? A Treasury Bill with 90 days to maturity,a face value of$100,000, and selling for

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-74bdaeeac8754562855f3aa85ba153c9.png)